S&P Global, renowned for the S&P 500 Index, has introduced a new rating system for stablecoins, evaluating their stability and ability to maintain their fiat pegs. In its first assessment of eight major stablecoins, none achieved the highest rating, while two were ranked the lowest.

To formulate its ratings, S&P Global focuses initially on asset quality risks, followed by risk mitigation factors, and then evaluates governance, legal and regulatory compliance, redeemability, liquidity, technological aspects, third-party dependencies, and historical performance.

S&P Global Ratings senior analyst Lapo Guadagnuolo commented on the significance of stablecoins in the financial market:

We see stablecoins becoming further embedded into the fabric of financial markets, acting as an important bridge between digital and real-world assets. Nonetheless, it’s important to acknowledge that stablecoins are not immune to factors such as asset quality, governance, and liquidity.

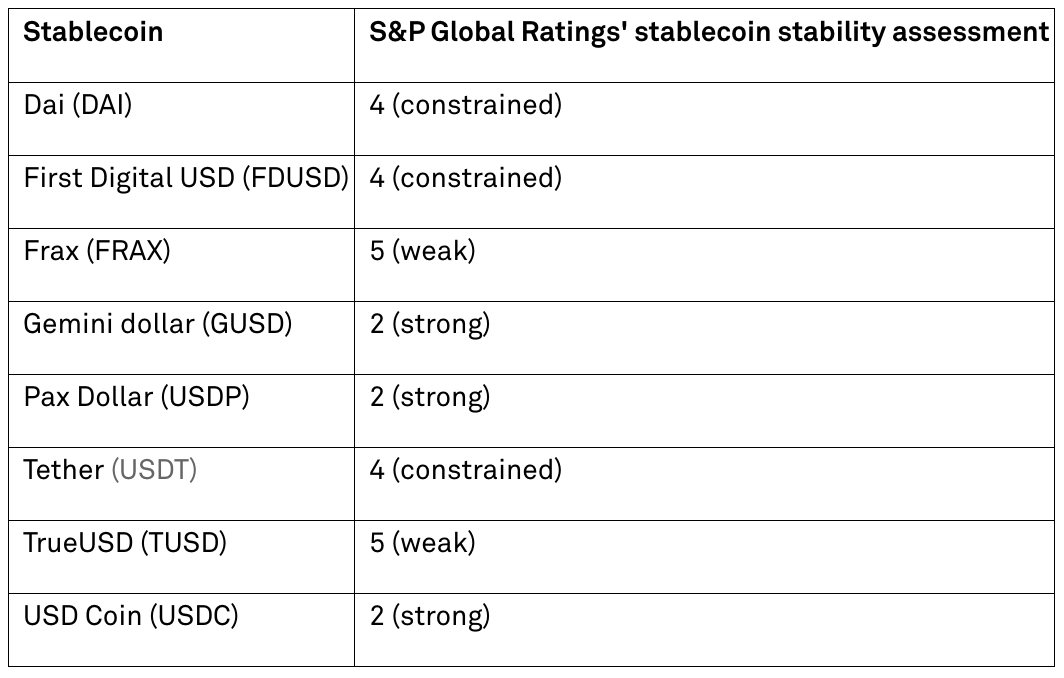

In the ratings, Gemini Dollar (GUSD), Pax Dollar (USDP), and USD Coin (USDC) received a score of 2 (strong), the highest in this round, attributed to the solid quality of their asset backing. Both Gemini and Pax are regulated by the New York State Department of Financial Services.

Tether (USDT), the market leader in terms of market cap, received a rating of 4 (constrained), primarily due to transparency concerns about its asset backing. TrueUSD was rated 5 (weak) for similar reasons regarding transparency. FRAX also received a 5, reflecting its reliance on an algorithm despite a shift towards USD backing.

This development follows Moody’s foray into stablecoin analysis with its Digital Asset Monitor service in November, utilizing artificial intelligence for assessment.